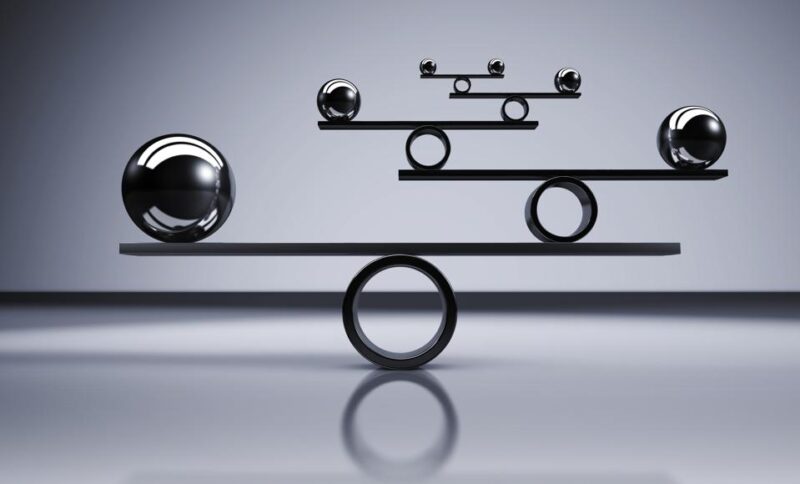

Financial leverage can be a powerful tool for businesses, offering the potential for accelerated growth and increased returns. However, it also carries inherent risks that must be carefully evaluated. In this article, we will explore the pros and cons of financial leverage, highlighting its benefits and potential drawbacks. By understanding both sides of the equation, businesses can make informed decisions about utilizing leverage to achieve their goals.

Also read: Understanding Financial Leverage: A Comprehensive Guide

Table of Contents

The Pros of Financial Leverage

- Enhanced Investment Capacity: Financial leverage allows businesses to access additional funds beyond their own capital, thereby increasing their investment capacity. With more resources at their disposal, companies can pursue larger projects, expand their operations, and explore new growth opportunities.

- Magnified Returns: By utilizing borrowed funds, businesses can potentially amplify their returns on investment. This means that if the investment performs well, the gains realized will exceed what would have been possible using only the company’s own capital.

- Flexibility in Capital Structure: Financial leverage provides businesses with flexibility in structuring their capital. By incorporating debt into their capital structure, companies can balance their funding sources and optimize their cost of capital.

The Cons of Financial Leverage

- Increased Risk: One of the significant downsides of financial leverage is the increased risk it introduces. By borrowing funds, businesses assume the obligation to repay the debt along with associated interest. If the investment does not generate the expected returns, the company may face difficulties in meeting its debt obligations.

- Interest Payments and Debt Servicing: Financial leverage entails regular interest payments and principal repayments. These obligations can place a strain on a company’s cash flow and financial resources, reducing the flexibility to allocate funds to other critical areas of the business.

- Exposure to Market Fluctuations: Leveraged investments are more susceptible to market fluctuations. Changes in interest rates, economic conditions, or industry-specific factors can impact the company’s ability to generate returns and meet its debt obligations.

Assessing Risk and Reward

- Evaluating the Cost of Debt: Before leveraging, businesses should carefully evaluate the cost of debt, including interest rates and associated fees. It is essential to compare the potential returns on investment with the cost of borrowing to determine if the leverage is worthwhile.

- Risk Management Strategies: Implementing risk management strategies is crucial when utilizing financial leverage. This may involve diversifying investments, maintaining a well-balanced portfolio, and having contingency plans in place to mitigate potential risks.

- Thorough Financial Analysis: Businesses should conduct a thorough financial analysis to assess the feasibility and potential impact of leveraging.

Determining Optimal Leverage Levels

- Analyzing Debt Capacity: Before implementing financial leverage, businesses need to evaluate their debt capacity. This involves assessing their current financial health, cash flow projections, and debt-to-equity ratios. Understanding the maximum amount of debt the company can responsibly take on helps avoid excessive leverage.

- Consideration of Industry Dynamics: Different industries have varying risk profiles and capital requirements. It is crucial to consider the specific dynamics of the industry in which the business operates when determining the optimal leverage levels. Industries with stable cash flows and low volatility may be better suited for higher leverage, while those with more cyclical or uncertain revenue streams may require more conservative approaches.

- Maintaining a Balanced Capital Structure: Striking a balance between debt and equity is essential for financial stability. While leverage can boost growth opportunities, an excessively high debt-to-equity ratio can increase financial vulnerability. Maintaining a well-balanced capital structure that aligns with the business’s risk tolerance and growth objectives is crucial.

Mitigating Risks and Ensuring Success

- Regular Monitoring and Review: Once financial leverage is implemented, it is essential to continuously monitor and review the performance of leveraged investments. This includes regular assessment of financial statements, debt service coverage ratios, and compliance with loan covenants. Timely identification of any adverse trends or potential risks allows for proactive measures to mitigate them.

- Building Strong Relationships with Lenders: Developing strong relationships with lenders can be beneficial when utilizing financial leverage. Effective communication, transparency, and a demonstrated track record of financial responsibility can help maintain lender confidence and potentially improve borrowing terms.

- Sound Financial Planning: Robust financial planning is critical when leveraging capital. This includes scenario analysis, stress testing, and sensitivity analysis to assess the potential impact of different market conditions on the company’s ability to meet its debt obligations. Comprehensive financial planning ensures that the business can weather potential challenges and capitalize on opportunities.

Conclusion

Financial leverage can be a double-edged sword, offering opportunities for accelerated growth and enhanced returns, but also introducing increased risks. Businesses must carefully evaluate the pros and cons of leveraging, assess their risk tolerance, and implement appropriate risk management strategies. By maintaining a balanced capital structure, conducting thorough financial analysis, and monitoring performance, companies can effectively utilize financial leverage to drive business growth while mitigating potential drawbacks.