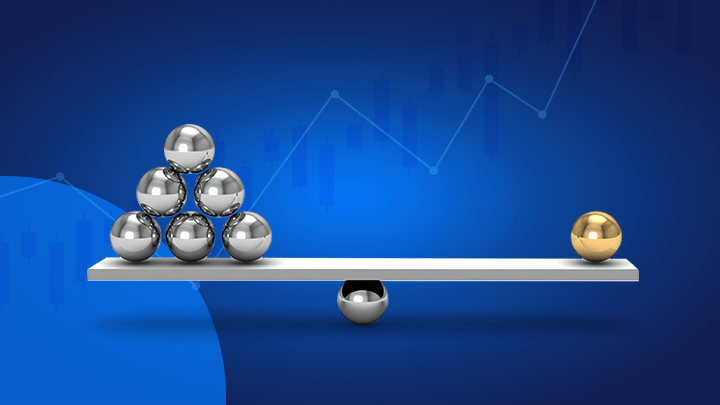

Financial leverage ratios are essential metrics that provide insights into a company’s capital structure and its ability to meet its financial obligations. By analyzing these ratios, investors and stakeholders can assess a company’s financial health, risk profile, and overall performance. In this guide, we will explore the key aspects of financial leverage ratios, how to calculate them, and their interpretation.

1. Introduction to Financial Leverage Ratios

- Defining Financial Leverage Ratios

- Importance of Financial Leverage in Financial Analysis

2. Common Types of Financial Leverage Ratios

- Debt-to-Equity Ratio (D/E)

- Debt Ratio

- Equity Ratio

- Interest Coverage Ratio

3. Calculating Financial Leverage Ratios

- Step-by-Step Guide to Calculate Debt-to-Equity Ratio

- Formula and Calculation of Debt Ratio

- Calculating Equity Ratio

- Determining Interest Coverage Ratio

4. Interpreting Financial Leverage Ratios

- Understanding the Significance of Debt-to-Equity Ratio

- Analyzing Debt Ratio and Its Implications

- Interpreting Equity Ratio as a Measure of Solvency

- Importance of Interest Coverage Ratio in Assessing Borrowing Capacity

5. Factors Affecting Financial Leverage Ratios

- Industry Norms and Benchmarks

- Business Life Cycle Stage

- Economic Conditions and Interest Rates

6. Comparing Financial Leverage Ratios

- Intercompany Analysis: Benchmarking Against Competitors

- Historical Analysis: Assessing Trends and Changes Over Time

7. Limitations and Caveats of Financial Leverage Ratios

- Potential Distortions in Ratios

- Varying Definitions and Calculation Methods

- Additional Analysis Required for Accurate Interpretation

8. Utilizing Financial Leverage Ratios for Decision-Making

- Assessing Risk and Return Trade-Offs

- Supporting Investment Decisions

- Monitoring Financial Health and Performance

Conclusion

Financial leverage ratios play a crucial role in evaluating a company’s financial position, risk profile, and ability to meet its obligations. By calculating and interpreting these ratios, investors and stakeholders gain valuable insights into a company’s capital structure and financial performance. However, it is essential to consider industry norms, economic conditions, and other contextual factors when interpreting these ratios. By utilizing financial leverage ratios effectively, businesses and investors can make informed decisions and navigate the complex landscape of finance with confidence.